Starting a new venture in India is exciting and challenging. Among the many decisions startup owners have to make, one of the most significant ones is to choose the right cost accounting model.

The choice between fixed cost v/s variable cost models directly impacts the startups’ cash flow, scalability, pricing strategy and long-term survival.

Here comes the role of the professional Accounting Outsourcing Services in India to play.

What is Cost Accounting?

Cost Accounting helps businesses understand where the money is spent and how costs behave when sales increase or decrease. They are broadly classified into two types.

- Fixed Costs – These are the costs that remain the same regardless of production or sales

- Variable Costs- These costs change based on the output or sales volume.

Fixed Cost Accounting Model for Startups

In this model, the expenses remain constant even if the sales fluctuate. The most common fixed costs for the startups are –

- Rent of Office or co-working space fees

- Salaries of full-time employees

- Software subscriptions

- Internet and Utilities

- Insurance and Licenses

Benefits of the Fixed Cost Model for Startups

- Predictable Monthly Expenses: The fixed costs make the budget easier. The startup owners need to know how much money is required every month.

- Better long-term scalability: With the growth of the startup business revenue, the fixed costs get spread over sales, improving the profit margins.

- Easy Financial Planning: This model is ideal for startups with steady demand and predictable income.

Disadvantages of the Fixed Cost Model

- High Financial Pressure

- High risk for early-stage startups

- Lower Flexibility

Variable Cost Accounting Model for Startups

In this model, the expenses rise or fall with production or sales volume. The most common variable costs for the startups are-

- Raw materials

- Packaging and Logistics

- Sales commission

- Consultants

- Cloud hosting usage

Benefits of the Variable Cost Model for Startups

- Less Financial Risk: The startups pay when they earn. It is a perfect model for bootstrapped or early-stage startups.

- High Flexibility: The businesses can easily scale operations up or down based on demand

- Cash Flow Control: This model allows the owners to have better cash flow control during slow periods. As they can decide on no heavy monthly obligations during this time.

- Testing Business Ideas: It is an ideal model for testing business ideas- pilot launches, new markets and MVPs.

Disadvantages of the Variable Cost Model

- Lower Profit Margins at scale

- Less Predictability

- Dependency on External Resources

Fixed Cost v/s Variable Cost Business Model- Quick Comparison

Choosing between the fixed cost and variable cost business model is a key decision for startups.

- Understanding Both: A fixed cost model includes expenses that remain constant irrespective of sales or production levels. These costs include office rent, permanent staff salaries, software tools, insurance and licenses. This model offers stability and predictability in budgeting, making it easier for startups to plan finances. In the variable cost model, the expenses change according to business activity. Costs increase when sales grow, and demand slows. The common variable costs include raw materials, freelancers, logistics, commissions and more. A variable cost model helps owners manage cash flow efficiently, reducing financial risk.

- Financial Risk V/s Cash Flow: Fixed cost models carry higher financial risk because the expenses continue even when revenue drops. Startups must maintain sufficient cash reserves to meet obligations. Variable cost models align expenses closely with income, making them safe for bootstrapped startups and those with unpredictable revenue. It is easy to manage cash in a variable cost model for startups.

- Scalability and Profitability: The fixed cost models become more profitable as the business scales, since costs remain stable while revenue increases. This improves margins over time. Variable cost models offer flexibility but may limit profitability at scale, as costs increase alongside sales.

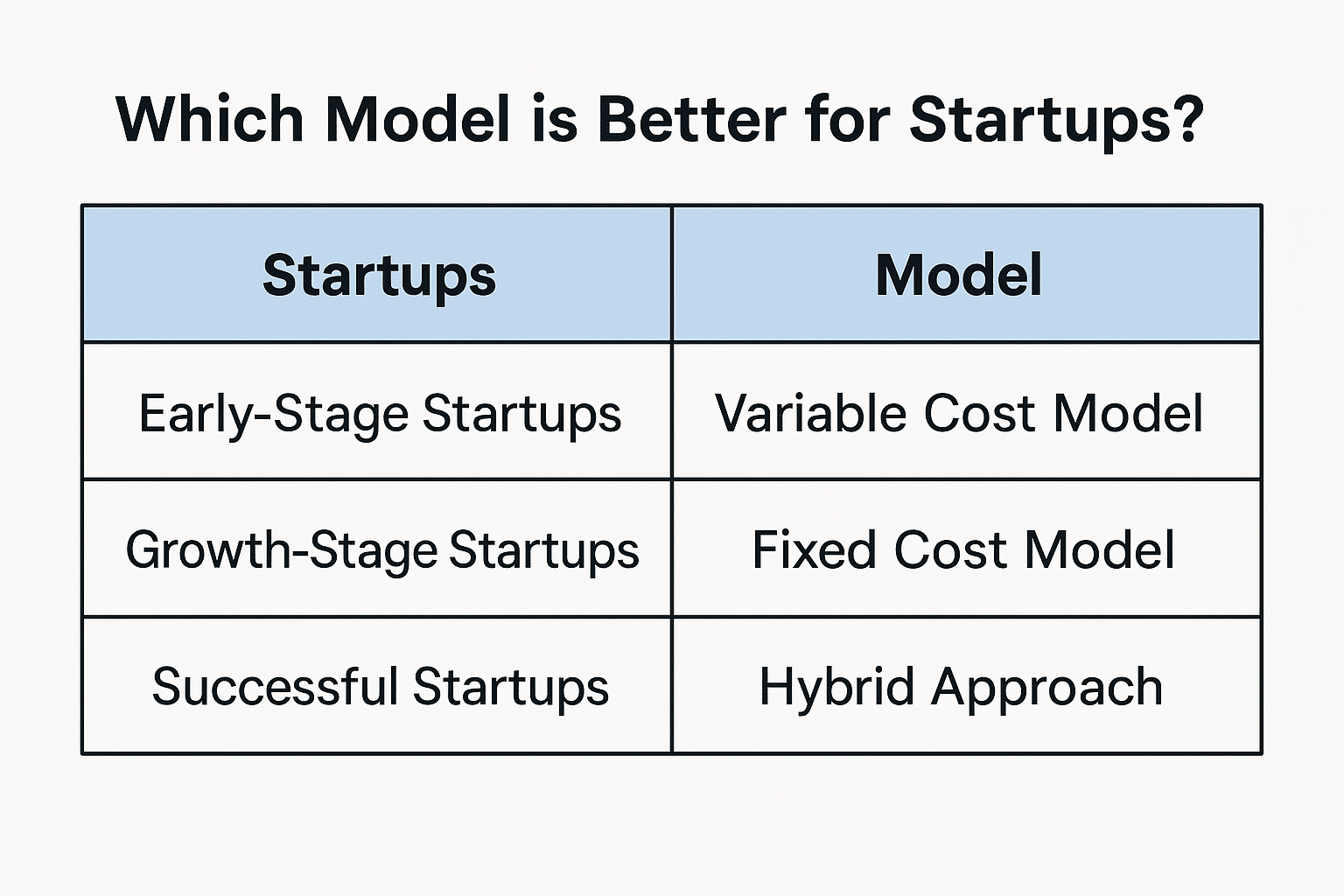

- Startup Stage: Early-stage startups benefit from a variable cost model due to uncertainty and limited capital. The fixed cost model is best for growth stage startups that have consistent revenue, as it will support their long-term expansion.

- Hybrid Approach: Most successful startups adopt a hybrid cost model, maintaining essential fixed costs while keeping non-core functions variable. This approach balances flexibility, stability and cost control, supporting sustainable growth.

Understanding the difference between the fixed and variable costs in accounting helps the startup’s founders make smarter financial decisions at every stage of growth.

How Professional Service Providers Help Choose the Right Model?

Choosing the right accounting cost models for startups is important. However, many startup owners find it challenging to choose the best one tailored to their business needs. Working with a professional outsourced service provider will help you make an informed choice.

- Business Stage: The service providers begin by evaluating the startup’s current stage, revenue stability and cash flow position. This helps determine which cost model – fixed, variable or hybrid is financially viable for the business.

- Cost Behavior: Experts study historical data, projected sales and expenses trends. This helps them understand how the costs behave at different growth levels. This analysis ensures the selected cost model aligns with actual business performance instead of assumptions.

- Cash Flow and Risk Management: The dedicated outsourced advisors help the businesses maximize financial risk by matching cost structures with income cycles. They track the areas where costs remain flexible during uncertain periods and recommend fixed investments only when the revenue improves.

- Growth Strategy: Professional services ensure the cost model supports long-term goals such as scalability, market expansion or investor readiness. They ensure the chosen cost model allows the business to grow sustainably without impacting profitability.

- Review: As startups evolve, the service providers review cost efficiency and suggest timely transitions between models. This ongoing support helps businesses stay agile, cost-effective and financially stable.

Work with a professional outsourced service provider and choose the best cost accounting model that best fits your business.

FAQs

1. What is fixed cost accounting model?

It is a system where business expenses remain constant regardless of changes in sales or production volume. Work with Anbac Advisors to decide the right cost accounting model for your startup venture.

2. What is the variable cost accounting model?

It is a system where business expenses change in direct proportion to the level of production or sales.

3. Why do many successful startups go for a hybrid model?

Many successful startups choose a hybrid model because it combines cost stability with flexibility, allowing them to scale efficiently while managing financial risk. Anbac Advisors helps you choose the best model for your business.

About the Author

Anbac Advisors is a trusted professional advisory firm offering strategic finance, business consulting and startup related advisory services. Focused on providing clarity, financial control and sustainable growth, the firm works closely with businesses including startups to enhance financial planning, cash flow management, regulatory compliance, choosing the right cost accounting model and investor readiness.