In the digital era, the successful running of the business is challenging for many businesses, especially for startups.

From managing cash flow to making data-backed investment decisions, finance plays a key role in whether a company struggles or thrives in the competitive market. Here comes the role of the professional Virtual CFO Services to play.

Traditionally, many businesses relied on the in-house Chief Financial Officers (CFOs) to manage these responsibilities. However, not every organization can afford the high salary of a full-time CFO. A good virtual CFO provides the same expertise as a traditional CFO but in a flexible, scalable and affordable way.

What is Virtual CFO?

A Virtual CFO is a financial expert or team of professionals who provide CFO-level support to businesses on a part-time, contractual or remote basis. They offer the same solutions as an in-house CFO, including financial strategy, budgeting, forecasting and compliance, without the heavy cost of hiring a full-time expert.

Virtual CFO Services in India

The Virtual CFO Services include-

- Financial Planning and Analysis

- Budgeting and Forecasting

- Cash Flow Management

- Compliance and Risk Management

- Tax Planning and Advisory

- Investors Relations and Fundraising Support

- Performance Monitoring through dashboards and reports.

Importance of working with Outsourced CFO Services in India

The increasing growth in responsibilities adds to the workload, thus many businesses, including startups in India, outsource CFO services to a professional and experienced firm.

- Cost Efficiency: Hiring a full-time Chief Financial Officer can be costly, which many Indian businesses cannot afford. Virtual CFOs provide the same expertise and services at a fraction of the cost, ensuring businesses have financial leadership without financial strain.

- Access to Expert Knowledge: Most virtual CFOs have good experience across industries. Working with them, businesses gain access to diverse financial insights, proven strategies and sector-specific expertise that they may not otherwise afford.

- Scalable Solutions: Whether it is a startup business or an SME, Virtual CFO Services scale according to the business needs. Companies can increase or reduce hours, services or focus areas as their business evolves.

- Focus on Core Business: By outsourcing financial management to the expert service provider, business owners and management teams can focus on their core business operations, innovation and growth instead of getting involved in financial complexities.

Benefits of Virtual CFO Services

- Strategic Financial Planning: A Virtual CFO designs tailored financial strategies for their clients aligned with their long-term goals. They help businesses set measurable targets, monitor performance and make adjustments to achieve sustainable growth.

- Ensures Competitive Edge: Virtual CFOs monitor the Key Performance Indicators, including sales, production, marketing, cash flow and inventory. These parameters epitomize the company’s current financial health and also predict future trends. The CFOs track KPIs, helping businesses stay ahead in the race and make informed adjustments.

- Effective Management of Cash Flow: Cash is the lifeline of every business. Virtual CFOs analyze inflows and outflows, identifying leakages and setting policies to ensure the business always has enough liquidity for operations expansion.

- Prepares Growth Plan: A Virtual CFO services develops growth plans tailored to the company’s specific financial goals. They plan for cash inflows to support expansion as the business grows.

- Advanced reporting and analytics: With the help of financial dashboards and tools, Virtual CFOs provide real-time insights into expenses, profits and investments. The data-driven reports empower businesses to make informed and timely decisions.

- Fund-Raising and Investor Relations: If you are a startup or SME and seeking to raise capital, work with a good Virtual CFO. They will prepare financial models, investor decks and due diligence reports. They also act as a bridge between the business and potential investors.

- Regulatory Compliance and Risk Management: The professional online CFO services ensure businesses stay compliant with tax laws, accounting standards and government norms. They implement risk management frameworks to protect assets and reputation.

- Organizational Structure: Virtual CFOs can adjust the organizational structure as required to support business growth, ensuring the roles and responsibilities align with the strategic goals.

- Management of Risk: One of the significant roles of a Virtual CFO is identifying and managing risk. They analyze potential risks and implement safeguards. They help minimize long-term financial threats and improve the company’s stability.

Top Virtual CFO Companies in India- Important Role They Play for Businesses

Virtual CFO services are important for businesses because of the following reasons, including –

- Financial Advisory: A virtual CFO firm provides customized financial guidance and supports business growth and expansion. They craft data-based and proper financial planning, helping the startup owners or the top management focus on core business areas without being worried about finance.

- Break-Even Analysis: A reputed online Chief Financial Officer help determine the break-even point where costs equal income, enabling the businesses to control expenses effectively.

- Accounting Functions: Startup CFO Services in India provides comprehensive accounting solutions. They do accounting health checks, review financial practices, policies and KPIs to ensure strong financial health.

- Cash Flow Forecasting: Virtual CFOs predict cash flows to help businesses plan for future obligations and make informed financial decisions.

- Management of Cost: The experts work to reduce costs by analyzing and controlling variable expenses, ensuring better financial efficiency.

- Support Audit: They help the firms in their audit, assisting in audit questions, providing required information and support during audits.

- Debt Planning: A virtual CFO creates a strategic debt plan to control liabilities and achieve financial goals.

• Budgeting: They help businesses track their expenditures, manage budgets and make adjustments to meet their financial targets. - Corporate Governance: A professional online Certified Financial Officer ensures compliance with regulations, balancing the interests of stakeholders and clients.

- Compliance with applicable Acts: The experts ensure their clients adhere to relevant laws such as the Companies Act, FEMA, Income Tax Act and more.

- MIS Reporting: They provide accurate and timely financial reports to keep the startup/SME owners or the management informed about the company’s financial health.

- Year-End Accounts Closure and Filing: The Chief Financial Officer ensures the timely filing of financial records, income tax returns and GST returns of their clients.

- Internal Controls: A virtual CFO helps establish effective internal controls, ensuring accurate financial records and informed decision-making.

- Accounting policies and procedures: The firm implements well-defined accounting policies and procedures to improve accountability and consistency within its clients’ businesses.

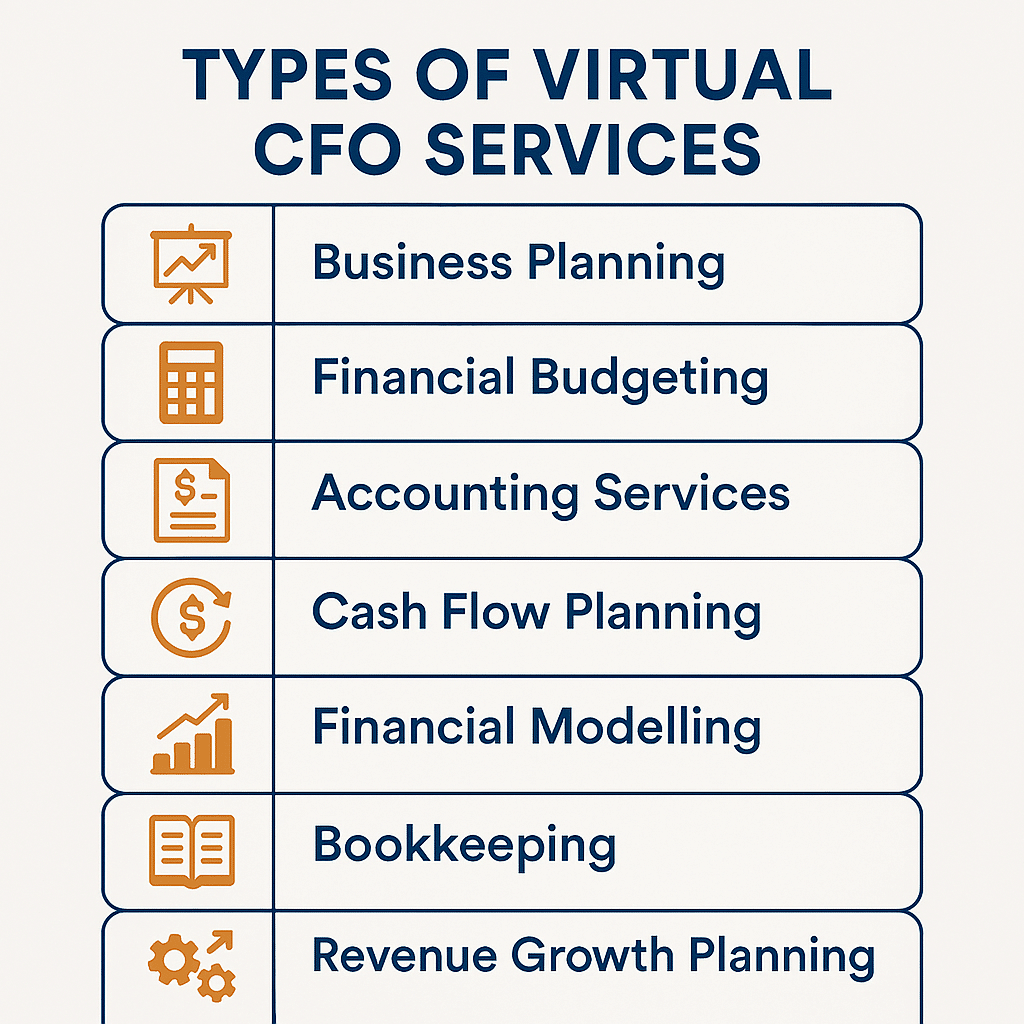

Different types of Virtual CFO Services

- Business Planning: Virtual CFO business planning services offered by the best Virtual CFO services in India help in generating an efficient business plan on the basis of accounting and financial reports.

- Financial Budgeting: These service providers monitor and record the financial health of businesses.

- Accounting Services: These services help businesses in maintaining, recording, evaluating and accounting finances, thus preventing leaks and cracks in the business operations.

- Cash Flow Planning: Cash Flow planning is important for every business to thrive, succeed and grow. These service providers have a strategic cash flow plan, helping the startups and other businesses have seamless cash flow.

- Financial Modelling: Bolster organization plans or investment choices with Financial Modelling Virtual Services.

- Bookkeeping: The professional online CFO Service Providers offer bookkeeping services, providing standardised procedures and systematic processes.

- Revenue Growth Planning: Companies can choose virtual chief financial officer services for revenue growth planning, helping them navigate the complex and competitive business environment of the digital era easily.

Types of Virtual CFOs providing remote Services

- Strategic Virtual CFOs: They offer long-term financial planning and growth strategies. They provide expert guidance on mergers, acquisitions and scaling opportunities. They are ideal for businesses seeking expansion and investment readiness.

- Operational Virtual CFOs: These experts handle daily financial tasks including budgeting, reporting and compliance. They work closely with the accounting teams to streamline the business processes. They are ideal for small and medium enterprises needing smooth financial operations.

- Startup Virtual CFOs: They specialize in building financial foundations for early-stage businesses. They help in fundraising, cost optimization and investor pitches for their startup clients. They also help the startups manage the burn rate and achieve sustainable growth.

- Industry-Specific CFOs: These Virtual CFOs bring sector expertise and offer customized strategies based on industry benchmarks and norms. They are beneficial for businesses operating in highly regulated markets.

- Project-Specific Virtual CFOs: These experts are hired for specific projects such as audits, fundraising or system implementation. They are the cost-effective option for organizations seeking expertise on demand.

Virtual CFO v/s Traditional CFO – Comparative Analysis

| Factor | Virtual CFO | Traditional CFO |

| Cost | Pay Per Service or Number of Man Hours, Cost Effective | High Salary and Benefits |

| Flexibility | Scales with business needs | Limited Scalability |

| Expertise | Access to multi-industry knowledge | Limited to one organization |

| Availability | Remote | On-site Only |

| Ideal For | Startups, SMEs and Growing Firms | Large Corporations |

| Adaptability | Easily Adaptable | Slow to adapt to business environment |

| Geographical Limitation | No geographical restrictions | Restricted to Specific location |

How to choose the right Virtual CFO Service Provider?

- Experience and Expertise: Work with a professional and experienced Virtual CFO with proven expertise across multiple industries.

- Customized Services: Make sure the service providers offer personalized services specific to the business stage and size.

- Technology use: Hire an online CFO who leverages the cutting-edge tools for reporting and compliance.

- Transparent Pricing: The reliable services opt for clear, upfront pricing models- hourly, retainer or project–based.

- Reputation: Check the client testimonials and reviews for credibility.

What are the stages of business where Virtual CFO services are important?

- Startup Stage: In the startup stage, the Virtual CFOs help establish accounting systems, budgeting frameworks and compliance structures from day one. They prepare financial models, projections and investor decks to attract capital for the startups. Startups often face irregular income. A virtual CFO ensures effective cash flow management, which is important for the survival and growth of every startup. The experts also identify unwanted expenses, guiding the startup owners on smart resource allocation.

- Growth Stage: Virtual CFOs design growth strategies that balance expansion with financial stability. They assess the risks related to scaling, such as higher overheads or new market entry. The experts streamline the financial processes like invoicing, payroll and vendor management. They set the Key Performance Indicators (KPIs) and build dashboards for real-time monitoring of business health.

- Maturity Stage: In this stage, Virtual CFOs shift their focus towards long-term sustainability and profitability. They ensure strict adherence to tax laws, audits and evolving industry norms. The Virtual CFOs maintain transparency and communication with stakeholders, investors or board members. In this stage, they help businesses explore new markets, product lines or acquisitions.

- Expansion or Pre-Exit Stage: The Virtual CFOs prepare financial records and compliance documentation for mergers, acquisitions or exits. They provide accurate company valuations for negotiation with investors or buyers. They craft the optimal financial strategies for large-scale growth or global expansion. They also support the founders with smooth transitions, planning, succession and IPO readiness.

- Crisis or Turnaround Stage: The Virtual cfo experts implement emergency cost-cutting measures and debt restructuring. They analyze financial bottlenecks and propose turnaround strategies. The experts rebuilt trust with lenders, suppliers and investors through transparent reporting. They also table measures to prevent the recurrence of financial instability.

Why are Virtual CFO Services Important for Startups?

Virtual CFO Services for Startups are important as they –

- Build the startup’s financial base by setting up their accounting systems, budgets and reporting structures.

- Make small businesses and startups investor-ready by preparing financial models, forecasts and pitch decks for fundraising.

- Ensure liquidity by tracking cash inflows, burn rate and expenses.

- Identify wasteful spending and guide optimum resource allocation.

- Offer insights on pricing, scaling and market entry.

- Ensure adherence to tax laws, audits and legal norms.

- Provide CFO-level advice without the cost of hiring full-time executives.

Financial leadership is not confined to large businesses anymore. With Virtual CFO service, small businesses, startups, and SMEs can access the same strategic expertise at an affordable cost.

FAQs

1. Do Virtual CFO services replace your accountant?

No. We collaborate with your accountant. The Virtual CFO focuses on strategy, planning, controls, MIS, and investor readiness while ensuring accounting and compliance are synchronized.

2. What tools do you use for reporting and dashboards?

We adapt to your stack (Tally, Zoho, QuickBooks, SAP B1, Odoo) and deliver dashboards via Excel, Google Sheets, or Power BI using standardized templates.

3. Why Anbac Advisors stands out as the best Virtual CFO Service Provider?

Anbac Advisors delivers tailored financial strategies, industry expertise and scalable solutions aligned with every stage of business growth at a cost-effective price making them stand out as the best Virtual CFO in Delhi, India.